Securing the right protection for your Ontario business is essential, and finding affordable insurance shouldn't be a daunting task. Whether you're a small startup or a well-established enterprise, understanding your coverage needs is crucial. With numerous insurance providers vying for your attention, comparing quotes can feel overwhelming. Thankfully, we simplify the process by connecting you with top-rated Ontario insurance companies who specialize in business protection.

Our user-friendly platform allows you to quickly obtain customized quotes tailored to your specific industry and coverage requirements. Simply provide some basic information about your business, and our system will generate competitive quotes from multiple providers. Review these quotes side-by-side to identify the best value for your money.

Don't delay the well-being of your business. Obtain Ontario Business Insurance Quotes today and ensure you have the coverage you need to succeed.

Oshawa Business Insurers Grow

The community of Oshawa is known for its robust business community, and regional brokers are stepping up to meet the growing demand for commercial insurance solutions. Lately, several insurance firms in Oshawa have been making moves to accommodate a wider range of businesses, providing specialized services for fields.

This trend reflects the vital role of commercial insurance in fueling Ontario's economy. With a dedication towards understanding the specific requirements of each business, Oshawa brokers are becoming as trusted consultants in helping businesses thrive.

Charting Uncertain Seas : Understanding Commercial Insurance in Ontario

Launching a business in Ontario is a unique set of challenges. From dynamic economic conditions to unexpected events, entrepreneurs must be prepared for anything. That's where commercial insurance comes in, providing a vital safety net to protect your venture. Understanding the various types of coverage available and how they can alleviate risk becomes essential for long-term success.

A comprehensive commercial insurance policy typically encompasses liability protection, property damage coverage, and business interruption insurance. Furthermore, specialized policies can be obtained to address particular risks.

Before selecting a policy, it's crucial to thoroughly assess your specific circumstances. Factors such as sales, the nature of your operations, and potential hazards should all be taken into account.

- Consulting an experienced insurance broker can help you navigate the complexities of commercial insurance in Ontario. They can provide personalized recommendations based on your individual requirements.

- Periodically review your policy coverage to ensure it remains aligned with your evolving business needs.

Company Insurance Premium Quotes: Compare Rates in Ontario

Securing the right business insurance coverage is vital for any Canadian enterprise. Premiums can vary significantly depending on factors like your sector, coverage, and risk. To ensure you're obtaining the best rates, it's highly recommended to evaluate quotes from several insurers.

Utilize web-based comparison tools or reach out to a licensed insurance advisor in Ontario to gather quotes from different insurance providers. Thoroughly review each quote, paying heed to the limits, deductibles, and limitations. Don't hesitate to inquire about anything that is ambiguous.

- Note that the lowest-priced quote isn't always the most suitable option. Consider the reputation of the insurer and their solvency.

- Shop around regularly to ensure you're still getting competitive rates as your business develops.

Protecting Your Bottom Line: Ontario Business Insurance Solutions

Running a successful business in Ontario requires careful planning and consideration. risk management are crucial aspects to ensure your venture thrives amidst the ever-changing economic landscape. However, one often overlooked element is adequate insurance coverage. A robust insurance plan acts as a safety net, protecting your assets and mitigating potential disasters. By securing comprehensive business insurance solutions tailored to your specific needs, you can safeguard your bottom line and focus on growing your enterprise with security.

- From liability protection to property coverage, Ontario offers a variety of policies designed to meet the unique requirements of different businesses.

- Seek guidance from an experienced insurance broker to determine the best solutions for your industry and circumstances.

- Regularly assess your insurance needs as your business evolves to ensure continued effectiveness of your coverage.

Securing the Right Fit: Expert Business Insurance Guidance in Ontario

Starting or growing a business in Ontario requires careful planning and consideration. A vital aspect of this process is ensuring your company is adequately protected with the right insurance coverage. Identifying the correct policies can be complex, which is where expert guidance comes in handy.

A qualified consultant can evaluate your individual business needs and propose tailored coverage options. They will help you in understanding the various kinds of insurance available, including property coverage, accident insurance, and more.

- Leveraging expert advice can provide you with peace of mind knowing your business is protected against potential risks.

- Additionally, it can help you reduce financial liability in the event of unforeseen circumstances.

When searching for business insurance in Ontario, it is crucial to undertake thorough research. Seek quotes New Policies for Ontario Corporations from multiple insurers, and carefully examine their coverage before making a decision.

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Mackenzie Rosman Then & Now!

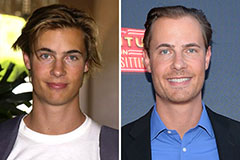

Mackenzie Rosman Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!